Last updated: June 2025

ITR Filing rules 2025: Hey there, fellow taxpayers! If you’re a salaried employee, listen up – the rules for filing your income tax return (ITR) just got stricter this year. I know tax stuff can be confusing, so let me break it down for you in simple terms.

The big change: new ITR Filing rules 2025

Gone are the days when just submitting Form 16 was enough. Starting 2025, the tax department wants actual proof for every deduction you claim. No more shortcuts – if you can’t show the documents, your claims might get rejected, and worse, you could face penalties.

Think of it like this:

- Before 2025: Your employer verified things like HRA, insurance, and investments. You just filed ITR-1 with Form 16, and that was it.

- Now in 2025: The tax department says, “Show us the receipts!” You need to upload proof for every tax-saving claim you make.

Don’t worry, though – I’ll guide you through exactly what documents you need and how to stay safe. Let’s make tax filing simple and stress-free this year!

Why the New ITR Filing Rules 2025? The Transparency Mandate Explained (The Plain Truth)

Income Tax Deadline 2025: Why Was the ITR Deadline Extended?

Why All These New Rules? (The Plain Truth)

The tax department noticed many fake claims (like imaginary rent receipts or inflated insurance premiums). So now, they’re saying: “Show us the proof!” It’s like when a teacher asks for your homework copy instead of just taking your word for it.

Key Goal: Reduce tax fraud (CBDT says 37% fewer fake claims expected).

What’s Actually Changed? Key Changes at a Glance

| Old Way (Before 2025) | New ITR Filing Rules 2025 Onwards | Why It Matters? |

|---|---|---|

| Form 16 = Golden Ticket | Form 16 + Proofs Needed | No more “trust me bro” – show receipts! |

| Employer checked your HRA/80C claims | You must upload proofs to tax portal | Your responsibility now |

| Disability claims needed just a doctor’s note | UDID certificate + Form 10-IA mandatory | Stops fake disability claims |

5 Must-Have Documents (Don’t Skip These!)

1. For Education Loan (80E):

Bank’s interest certificate (with stamp) – like a report card for your loan.

2. For Disabled Dependent (80DD):

UDID card (get it from this govt site) + Doctor’s signed Form 10-IA.

3. For HRA:

Rent receipts with landlord’s PAN (if rent > ₹1 lakh/year). Pro tip: If landlord doesn’t have PAN, submit their Aadhaar.

4. For Health Insurance (80D):

Premium receipt showing policy number, your name, and payment date. Screenshot from insurer’s app works!

5. For LTA (Leave Travel Allowance):

Boarding passes or e-tickets. Lost them? Ask your travel agency for a duplicate.

Most Demanding Features – Tax saving beyond 80C 2025-26: Expert-approved strategies!

Real-Life Example: What Happens If You Ignore This?

Rahul’s Story (Delhi, 2025):

- Claimed ₹2 lakh tax savings under 80C (PF + LIC).

- Only uploaded Form 16, no LIC receipts.

- Result: Got a tax notice + ₹11,300 penalty.

His lesson: “Now I keep all proofs in a ‘Tax 2025’ WhatsApp folder!”

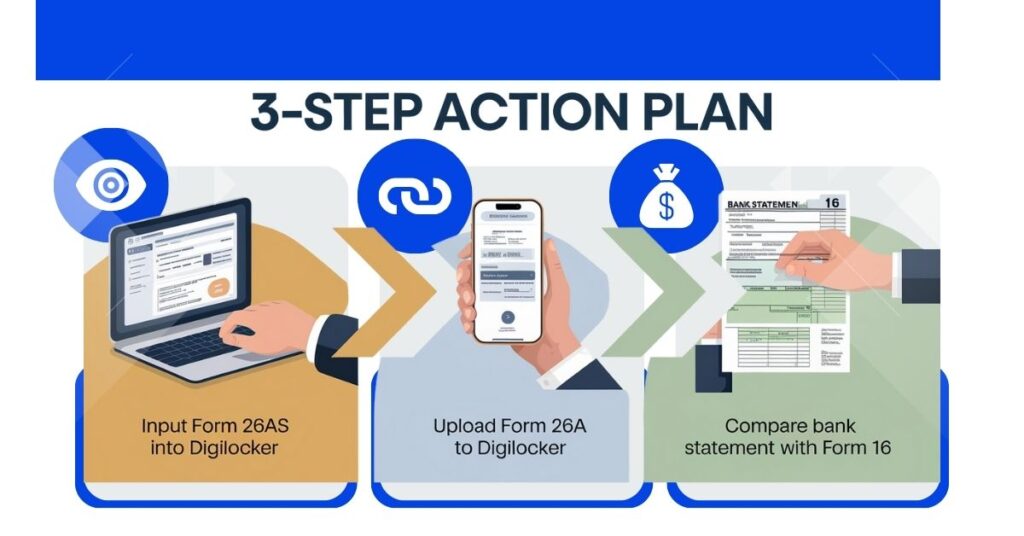

3 Simple Steps to Stay Safe

- Download Form 26AS (from incometax.gov.in) – Check if TDS matches your salary slips.

- Use DigiLocker – Store proofs here (govt-approved = no rejection).

- Compare Form 16 + Bank Statements – Like checking your grocery bill!

Also read, How to File ITR in India? 15 Proven Steps Expert Guide for 2025

FAQs – Answered in 1 Line Each!

Q1: I’ve no house rent. Still need HRA docs?

→ Only if you claimed HRA in Form 16. Else, ignore.

Q2: My health insurance is via company. Proof needed?

→ Yes! Ask HR for the policy certificate showing your name.

Q3: Lost my LIC receipt? What now?

→ Visit LIC branch or download from LIC’s portal.

Q4: Is Aadhaar enough if landlord has no PAN?

→ Yes! Write “PAN not available” in ITR and give their Aadhaar.

Q5: What if I miss the July 31 deadline?

→ File by Dec 31 with ₹5,000 late fee. After that, ₹10,000 + interest.

Expert’s Golden Advice

“Think of taxes like brushing teeth – do it right daily, not painfully at year-end!”

– CA Priya Menon (15+ years helping salaried taxpayers)

Do This Today:

- Make a Gmail folder → Label it “Tax 2025 Proofs”.

- Forward all insurance/rent/loan emails here.

- Relax – you’re now audit-proof!

Final Thought on new ITR Filing rules 2025

The new rules aren’t to scare you – they’re to protect honest taxpayers. A little organisation now saves major headaches later. Your future self will high-five you!

Need help? Book a free consultation via the IT Dept’s helpdesk.

Why This Matters to You

- No surprises: Avoid last-minute document hunts.

- Save money: Penalties can eat up your savings.

- Sleep better: No stress about tax notices.

Taxes don’t have to be hard. Now you know!