ITR-1 and ITR-4 changes AY 2025–26: Start with a surprising statistic about the number of taxpayers affected by ITR changes in India. The Income Tax Authority has officially released the updated Excel utilities for ITR-1 (Sahaj) and ITR-4 (Sugam) for the Assessment Year (AY) 2025–26, which is for income earned in Financial Year (FY) 2024–25.

This year (FY-2024- 2025), a lot has changed — from stricter validation rules to more detailed disclosure requirements. Whether you’re a salaried individual or a small business owner using the old tax regime, it’s important to understand what’s new before filing your income tax return.

Let’s break it down in simple language so you don’t miss anything.

Quick Highlights

- New Deadline: You now have time till 15th September 2025 to file your ITR.

- Applicable Forms: ITR-1 for salaried individuals, ITR-4 for small businesses or professionals under presumptive taxation.

- New Utilities: Excel-based ITR-1 and ITR-4 tools now come with smart error detection and validation.

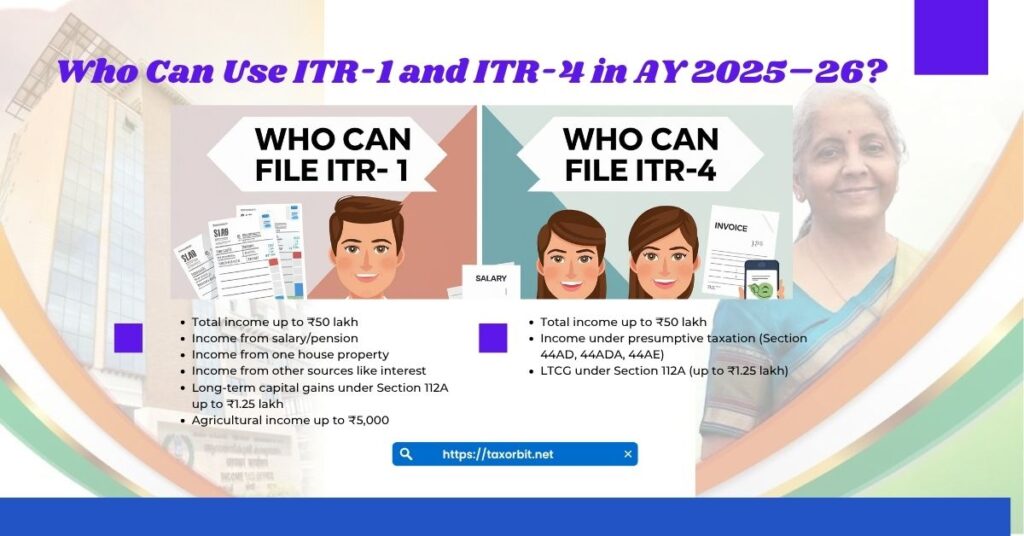

Who Can Use ITR-1 and ITR-4 in AY 2025–26?

Also read, How to File ITR in India? 15 Proven Steps Expert Guide for 2025

ITR-1 (Sahaj):

Best for resident individuals (not “Not Ordinarily Resident”) with:

- Total income up to ₹50 lakh

- Income from salary/pension

- Income from one house property

- Income from other sources like interest

- Long-term capital gains under Section 112A up to ₹1.25 lakh

- Agricultural income up to ₹5,000

Not Allowed: Company directors, holders of unlisted shares, people with foreign income/assets, or crypto income.

ITR-4 (Sugam):

Ideal for Individuals, HUFs, and Firms (excluding LLPs) with:

- Total income up to ₹50 lakh

- Income under presumptive taxation (Section 44AD, 44ADA, 44AE)

- LTCG under Section 112A (up to ₹1.25 lakh)

9 Big Changes in ITR-1 and ITR-4 Excel Utility for AY 2025–26

1. Detailed Disclosure for Deductions (Old Regime)

If you are using the old tax regime, you now need to provide more info for your deductions:

- Section 80C: Specify type (PPF, ELSS, NSC) and amount.

- Section 80D: Mention insurer name, policy number, and who the policy covers.

- HRA Claim: Must include landlord’s name and PAN if rent > ₹1 lakh.

- Education/Home Loans: Mention interest paid, lender name, and loan details.

Why This Matters: These steps reduce fraud and improve the accuracy of deductions.

More knowledgeable Topic: Tax saving beyond 80C 2025-26: Expert-approved strategies!

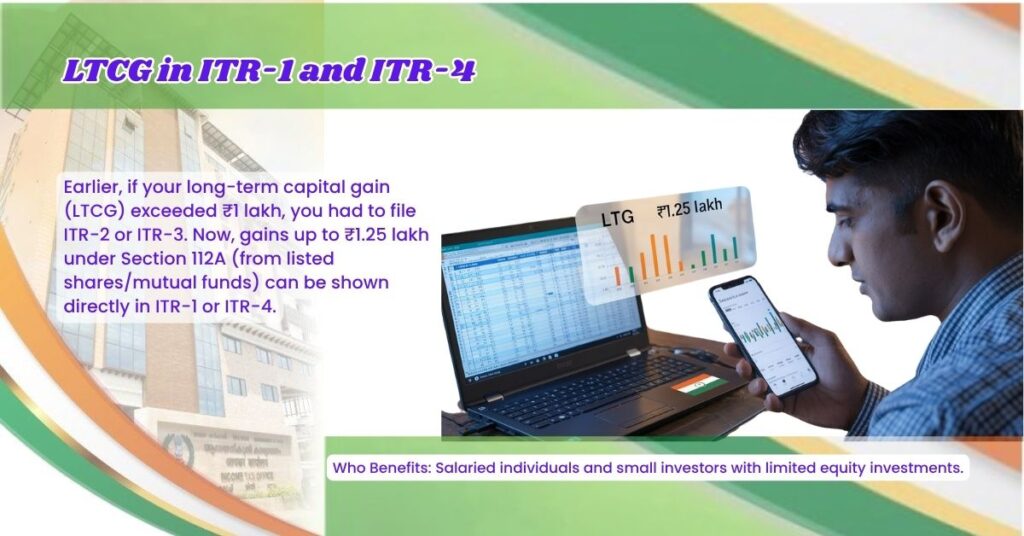

2. You Can Now Show LTCG in ITR-1 and ITR-4

Earlier, if your long-term capital gain (LTCG) exceeded ₹1 lakh, you had to file ITR-2 or ITR-3. Now, gains up to ₹1.25 lakh under Section 112A (from listed shares/mutual funds) can be shown directly in ITR-1 or ITR-4.

Who Benefits: Salaried individuals and small investors with limited equity investments.

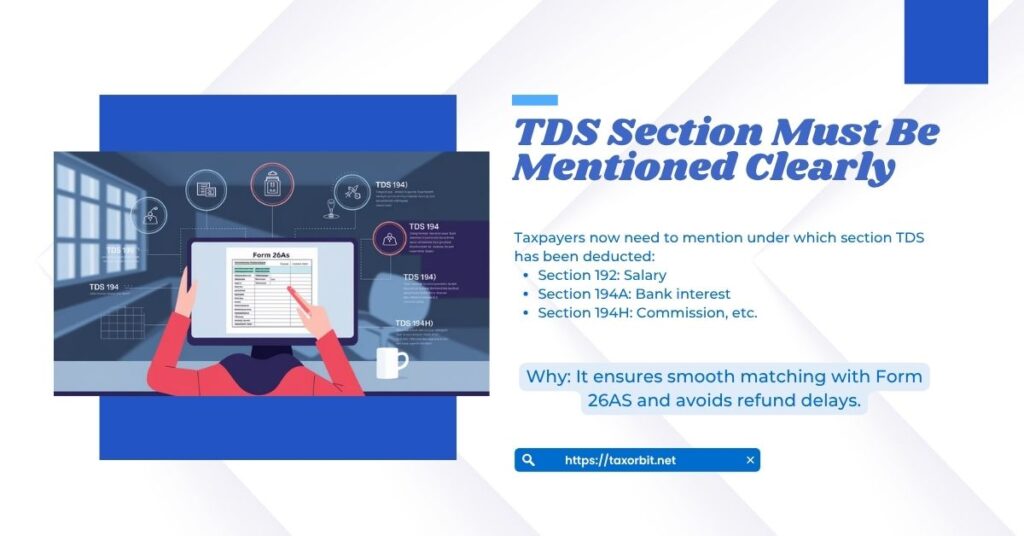

3. TDS Section Must Be Mentioned Clearly

Taxpayers now need to mention under which section TDS has been deducted:

- Section 192: Salary

- Section 194A: Bank interest

- Section 194H: Commission, etc.

Why: It ensures smooth matching with Form 26AS and avoids refund delays.

4. Asset Reporting Threshold Increased

Earlier, small business owners or professionals using ITR-4 had to declare their assets and liabilities. Now, if your total assets are under a higher limit (as per updated norms), you may be exempt from this requirement.

Benefit: Makes life easier for small taxpayers with fewer assets.

5. Clearer Home Loan Reporting (Self-Occupied Property)

If you have a home loan, you can now mention:

- Interest paid

- Lender name & PAN

- Property address

Why It’s Useful: Helps claim up to ₹2 lakh interest under Section 24(b) with more clarity.

6. Updated Capital Gains Sections

The ITR Excel utility now supports:

- Grandfathering clause for shares bought before 1st Feb 2018

- Indexation for non-equity assets

- Separate fields for short-term and long-term gains

Tip: Keep all purchase/sale documents handy while filing.

Know – All about capital gains Tax from CBDT

7. Smarter Excel Utility with Auto Error Detection

The new Excel tool is smarter than ever:

- Warns you if mandatory fields are left blank

- Auto-calculates tax and surcharge

- Shows pop-up tips and dropdowns

- Gives an error summary sheet for quick fixes

Why This Helps: Minimises filing mistakes, especially for first-time users.

8. Enhanced Aadhaar-PAN Linking Validation

From AY 2025–26, the ITR utilities will automatically verify the Aadhaar-PAN linkage status before allowing the return submission. If the PAN is not linked with Aadhaar (as mandated under Section 139AA), the utility will trigger a red alert and block submission until the issue is resolved.

Why this matters:

The Income Tax Department is moving toward real-time compliance enforcement. Aadhaar-PAN linkage is essential not only for validation but also for ensuring smooth e-verification and refund processing. Previously, many returns were held up due to unlinked PAN-Aadhaar status—this new change proactively prevents such issues at the filing stage itself.

Tip for Taxpayers:

Check your PAN-Aadhaar linking status at incometax.gov.in before starting your ITR filing process.

9. Dynamic Prefilled Data Verification Mechanism

The Excel utility for AY 2025–26 now includes a smart prefilled data validator that compares values pulled from your AIS (Annual Information Statement), Form 26AS, and TIS (Taxpayer Information Summary) with what you input in the ITR. If discrepancies are detected, the utility flags them for your review.

Why this matters:

This ensures better transparency and reduces the scope for unintentional underreporting or over-claiming. For example, if your interest income or capital gains differ from AIS records, you’ll be prompted to reconcile the difference before submission.

Benefit:

This helps avoid notice under Section 143(1)(a) or scrutiny due to mismatches, offering peace of mind and faster refund processing.

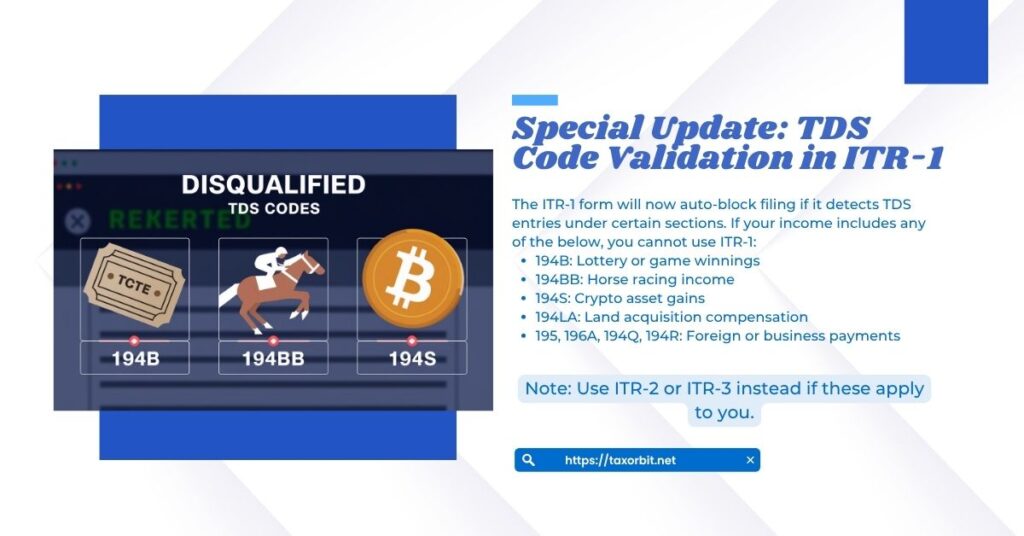

Special Update: TDS Code Validation in ITR-1

The ITR-1 form will now auto-block filing if it detects TDS entries under certain sections. If your income includes any of the below, you cannot use ITR-1:

- 194B: Lottery or game winnings

- 194BB: Horse racing income

- 194S: Crypto asset gains

- 194LA: Land acquisition compensation

- 195, 196A, 194Q, 194R: Foreign or business payments

Use ITR-2 or ITR-3 instead if these apply to you.

Smart Features in 2025–26 ITR Excel Tools

- Live validation of entries

- Auto-tax calculation

- Dropdown menus for section selection

- Instant alerts for missing fields

- Error summary page for fixing mistakes

Final Thoughts for Taxpayers – ITR-1 and ITR-4 changes AY 2025–26

The new ITR-1 and ITR-4 forms bring more transparency, accuracy, and compliance. But they also require you to be careful and thorough while filling your returns.

If you:

- Use the old tax regime

- Have multiple deductions

- Claim HRA

- Earn small LTCG

- Or run a small business,

…you must double-check every entry and use the correct form. With crypto, foreign, or gambling income — don’t file ITR-1, even by mistake.

Start preparing early and consider consulting a certified accountant (CA) or using official utility tools with caution. A small error could result in significant delays — or even a defective return notice.