Income Tax Deadline Extended: In a major relief for taxpayers, the Central Board of Direct Taxes (CBDT) has extended the deadline for filing Income Tax Returns (ITR) for FY 2024-25 (AY 2025-26) from July 31, 2025, to September 15, 2025126. This decision, announced on May 27, 2025, comes as a welcome move, providing taxpayers with an additional 46 days to file their returns accurately and avoid last-minute errors.

Income Tax Deadline: Table of Contents

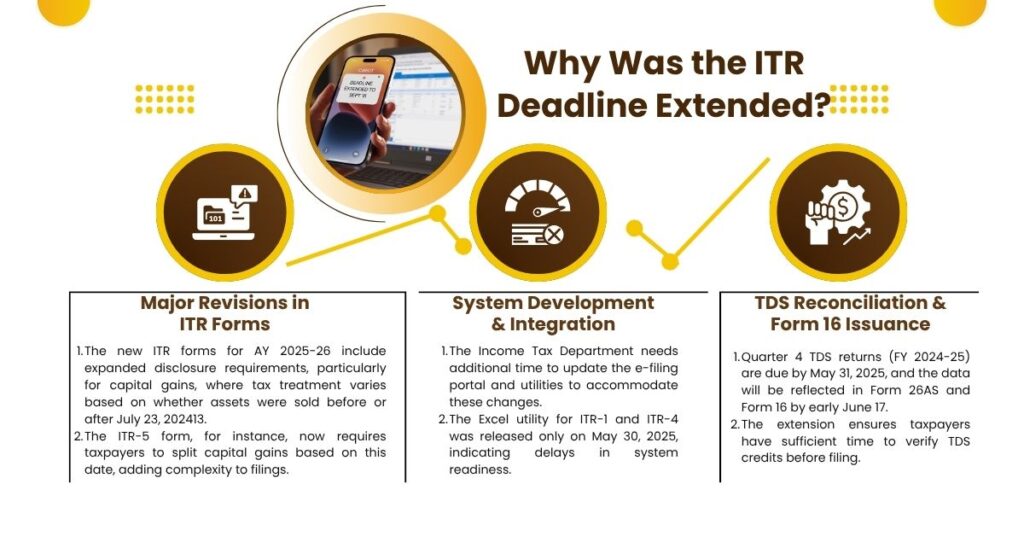

Why Was the ITR Deadline Extended?

The extension was introduced due to several key reasons:

- Major Revisions in ITR Forms

- The new ITR forms for AY 2025-26 include expanded disclosure requirements, particularly for capital gains, where tax treatment varies based on whether assets were sold before or after July 23, 202413.

- The ITR-5 form, for instance, now requires taxpayers to split capital gains based on this date, adding complexity to filings.

- System Development & Integration

- The Income Tax Department needs additional time to update the e-filing portal and utilities to accommodate these changes.

- The Excel utility for ITR-1 and ITR-4 was released only on May 30, 2025, indicating delays in system readiness.

- TDS Reconciliation & Form 16 Issuance

- Quarter 4 TDS returns (FY 2024-25) are due by May 31, 2025, and the data will be reflected in Form 26AS and Form 16 by early June 17.

- The extension ensures taxpayers have sufficient time to verify TDS credits before filing.

Income Tax Deadline Extended: Who Benefits from This Extension?

The new Income Tax Deadline applies to:

- Salaried individuals

- Self-employed professionals & businesses (non-audit cases)

- Hindu Undivided Families (HUFs)

- Firms, LLPs, AOPs, and BOIs (non-audit cases)

However, audit-required taxpayers (businesses with a turnover exceeding ₹1 crore or professionals with receipts exceeding ₹50 lakh) must still file by October 31, 2025. Those with transfer pricing reports have until November 30, 2025.

Also read, How to File ITR in India? 15 Proven Steps Expert Guide for 2025

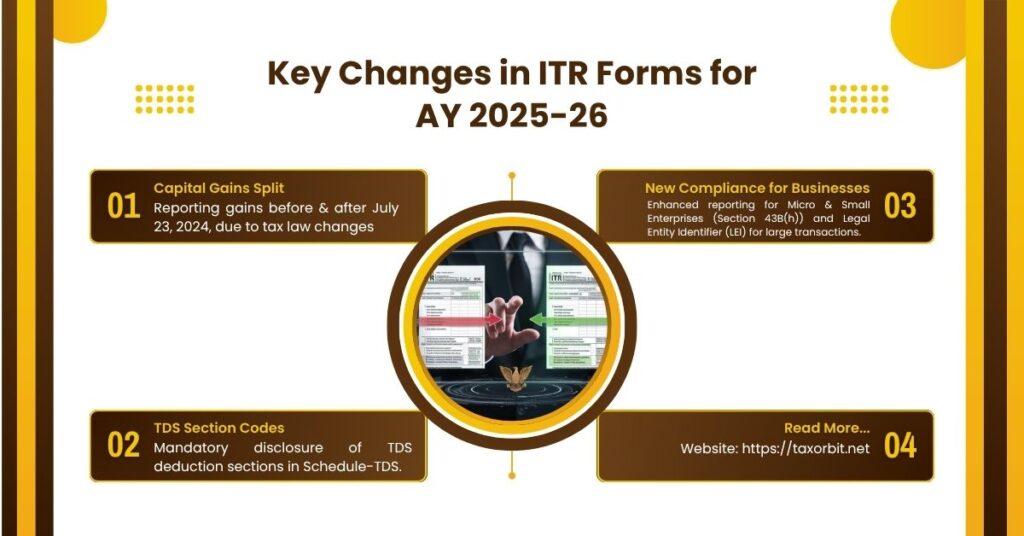

Key Changes in ITR Forms for AY 2025-26

The revised ITR forms introduce several updates:

- Capital Gains Split – Reporting gains before & after July 23, 2024, due to tax law changes.

- TDS Section Codes – Mandatory disclosure of TDS deduction sections in Schedule-TDS.

- New Compliance for Businesses – Enhanced reporting for Micro & Small Enterprises (Section 43B(h)) and Legal Entity Identifier (LEI) for large transactions.

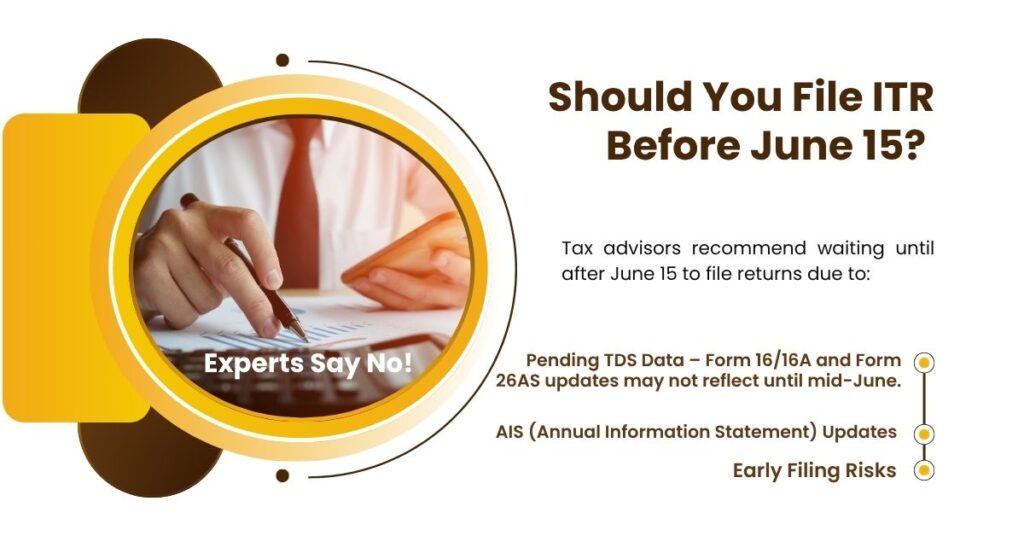

Should You File ITR Before June 15? Experts Say No!

Tax advisors recommend waiting until after June 15 to file returns due to:

- Pending TDS Data – Form 16/16A and Form 26AS updates may not reflect until mid-June.

- AIS (Annual Information Statement) Updates – Financial transactions (such as interest, dividends, and stock sales) are updated in AIS by mid-June.

- Early Filing Risks – Mismatches in TDS or unreported income can result in tax notices or delayed refunds.

Penalties for Missing the Deadline

While the deadline is extended, late filers still face:

- Late Fee (Section 234F): ₹5,000 (₹1,000 if income < ₹5 lakh).

- Interest (Section 234A): 1% per month on unpaid tax.

- Loss Carry-Forward Restrictions – Unclaimed losses (stocks, property, business) cannot be carried forward if filed after Dec 31, 2025.

What Should Taxpayers Do Now?

- Gather Documents Early – Collect Form 16, bank statements, investment proofs, and capital gains details.

- Verify TDS in Form 26AS – Cross-check TDS credits after June 10 to avoid mismatches.

- Use Pre-Filled Data Wisely – The Income Tax Portal will auto-fill some details; verify before submission.

- Avoid Last-Minute Rush – Filing in August or early September reduces errors and portal congestion.

Conclusion: A Welcome Move for Smoother Tax Compliance

ITR Deadline Extended: The CBDT’s decision to extend the ITR deadline to September 15, 2025, is a pragmatic step to ensure accurate filings amid major tax form revisions and system upgrades. While this provides relief, taxpayers should not delay preparations—early documentation and careful verification of TDS/AIS data will ensure a hassle-free filing experience.

For those seeking further clarification, the Income Tax Department’s e-filing portal (https://www.incometax.gov.in) will provide updated guidelines as the filing season progresses.

Stay informed, file accurately, and avoid last-minute stress!