Capital Gains Tax: Did You Know? Over 72% of Indian taxpayers overpay capital gains tax simply because they don’t understand the rules. Whether you’re selling property, stocks, or gold, this comprehensive guide explains everything in simple terms, using real-world examples, calculation formulas, and actionable strategies to help you save taxes legally.

Table of Contents

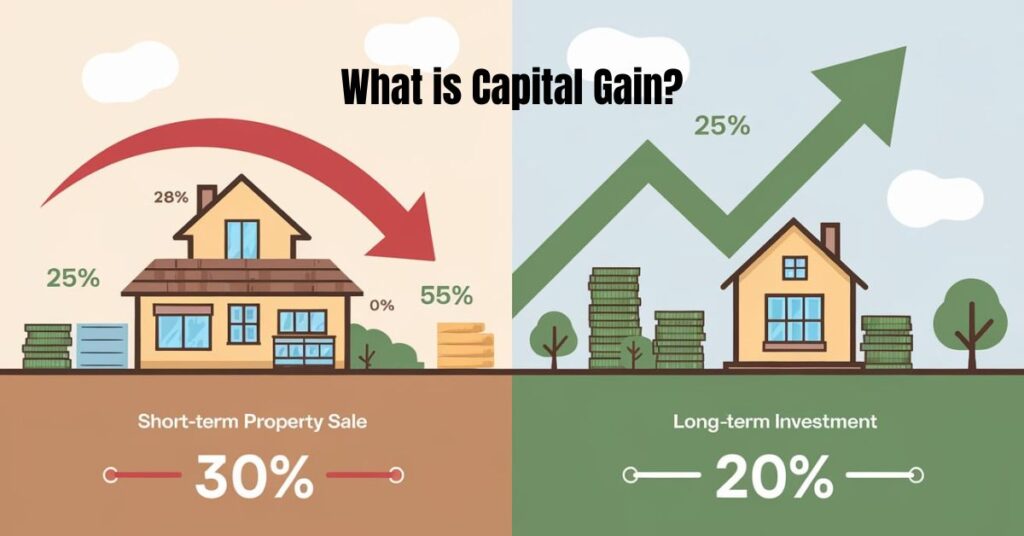

1. What is Capital Gain? (Detailed Explanation with Multiple Examples)

Capital gain is the profit you make when selling an asset for more than you paid. But there’s more to it:

How to Calculate Capital Gains

Basic Formula:

Capital Gain = Selling Price – (Purchase Price + Improvement Costs + Selling Expenses)

Real-life Examples:

- Property:

Bought flat in 2018: ₹50L

Spent on renovation: ₹5L

Sold in 2024: ₹80L

Brokerage paid: ₹1L

Capital Gain = ₹80L – (₹50L + ₹5L + ₹1L) = ₹24L - Stocks:

Bought 100 shares in 2022: ₹50,000

Sold in 2024: ₹1,20,000

Capital Gain = ₹1,20,000 – ₹50,000 = ₹70,000

Asset-wise Holding Periods (2025 Rules)

| Asset Type | Short-Term | Long-Term |

| Residential Property | ≤24 months | >24 months |

| Equity Shares/MFs | ≤12 months | >12 months |

| Gold | ≤36 months | >36 months |

Know more about the Capital Gains Tax Rule from CBDT

2. 2025 Capital Gains Tax Changes (Expected Reforms)

While not yet confirmed, these changes are being discussed:

Potential Major Changes in Capital Gains Tax

- Property: LTCG tax may increase from 20% to 25% with indexation

- Equities: Holding period for LTCG may extend from 1 year to 3 years

- TDS: Rate on property sales may rise from 1% to 2%

What This Means for You

Example Scenario: If you’re planning to sell stocks bought in 2024:

– Current rule: Sell after 1 year for 10% LTCG tax

– Possible 2025 rule: Must hold for 3 years for LTCG benefits

Also Read, New Tax Regime 2025: Revised Slabs, ₹75K Standard Deduction Explained

3. Complete Guide to Capital Gains Tax Relief Options (2025 Updates)

Section-wise Benefits

| Section | Applicable To | Benefit | Example |

| 54 | Residential Property | Reinvest gains in the new house | ₹50L profit → Buy ₹75L house = ₹0 tax |

| 54F | Any Asset | Invest in residential property | ₹1Cr from gold sale → Buy house = ₹0 tax |

| 54EC | Property/Land | Invest in specified bonds | ₹30L profit → ₹30L in REC bonds = ₹0 tax for 5 years |

New for 2025: Expected Changes to Reliefs

- Tighter timelines: Section 54 reinvestment period may be reduced from 2 years to 1 year

- Lower caps: Section 54EC investment limit may decrease from ₹50L to ₹30L

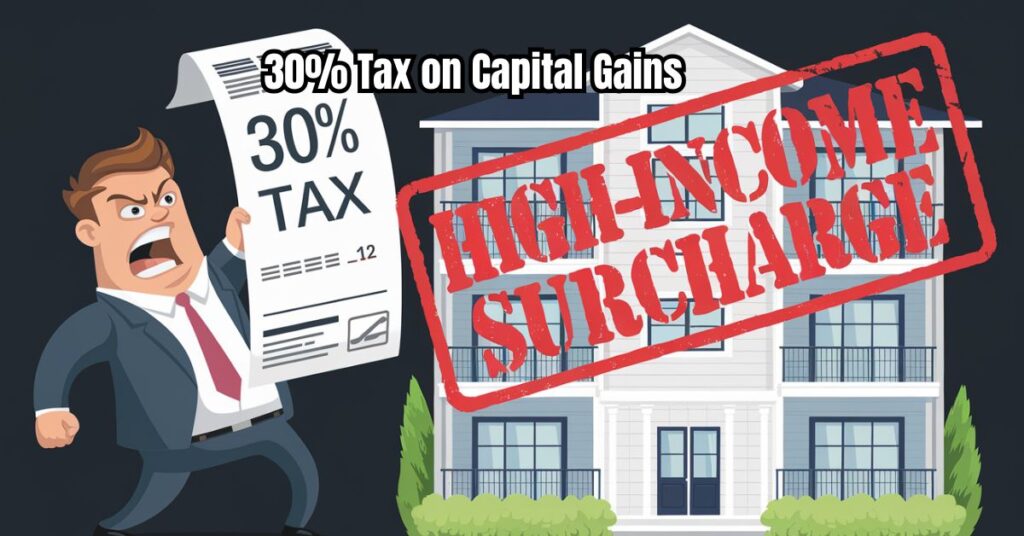

4. Understanding the 30% Capital Gains Tax (When It Applies)

Who Pays 30%?

- High-income individuals (₹50L+ annual income) selling:

- Property within 2 years

- Unlisted shares within 2 years

- STCG on certain speculative transactions

Detailed Example:

Mr. Kapoor (₹65L annual income) sells:

– Commercial property (held 18 months): ₹1.2Cr profit → 30% tax = ₹36L + cess

– Plus surcharge (since income > ₹50L): Additional 10% = ₹3.6L

Total tax = ₹39.6L

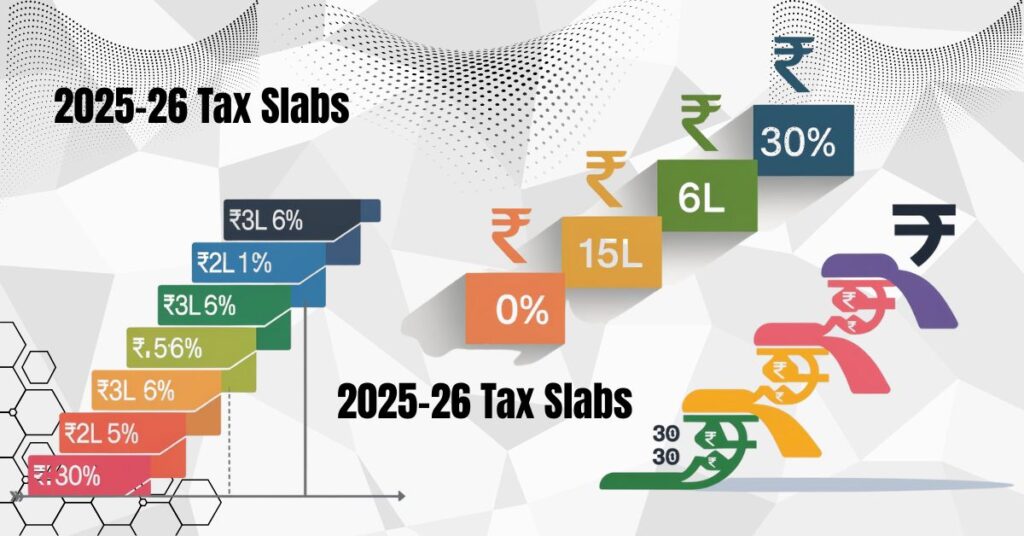

5. 2025-26 Tax Slabs: Projected Rates

Individual Taxpayers (Expected)

| Income Range | Tax Rate | Calculation Example |

| Up to ₹3L | 0% | ₹3L income = ₹0 tax |

| ₹3-6L | 5% | ₹6L income = 5% of ₹3L = ₹15,000 |

| ₹6-9L | 10% | ₹9L income = ₹15,000 + 10% of ₹3L = ₹45,000 |

| ₹9-12L | 15% | ₹12L income = ₹45,000 + 15% of ₹3L = ₹90,000 |

| ₹12-15L | 20% | ₹15L income = ₹90,000 + 20% of ₹3L = ₹1.5L |

| Above ₹15L | 30% | ₹20L income = ₹1.5L + 30% of ₹5L = ₹3L |

Special Cases

- Senior Citizens: Higher exemption limit (₹5L vs ₹3L)

- Super Senior Citizens (80+): ₹10L exemption

Know more about The Upcoming Tax Changes in India 2025: What You Need to know

6. Tax-Free Capital Gains: Complete Exemption Guide

Full Exemption Cases on Capital Gains Tax

- Residential Property (Section 54):

- Must buy a new house 1 year before or 2 years after the saleOr construct within 3 years

- New limit: ₹10Cr exemption (may reduce to ₹5Cr in 2025)

- Agricultural Land:

- Rural land: Always exempt

- Urban land: Must be used for agriculture for 2+ years

- Inherited Property:

- No tax if sold without improvements

- Tax only on value appreciation since inheritance

Partial Exemptions on Capital Gains Tax

- Equities/MFs: ₹1L/year LTCG free (Section 112A)

- Bonds: Up to ₹50L exempt under Section 54EC

7. Property Sale Taxes in 2025: New Rules Explained

Current vs Proposed Rates

| Factor | 2024 Rule | 2025 Expected |

| LTCG Rate | 20% with indexation | 25% with indexation |

| TDS Rate | 1% for ₹50L+ sales | 2% for ₹30L+ sales |

| Holding Period | 24 months for LTCG | 36 months for LTCG |

Practical Implications

Case Study: The Mehta family plans to sell their Mumbai apartment:

– Current scenario (2024):

Purchase (2019): ₹1.2Cr

Sale (2024): ₹2.5Cr

Indexed cost: ₹1.2Cr × (348/280) = ₹1.49Cr

LTCG: ₹2.5Cr – ₹1.49Cr = ₹1.01Cr

Tax: 20% of ₹1.01Cr = ₹20.2L

– If rules change (2025):

Same calculation but 25% tax = ₹25.25L

Extra tax: ₹5.05L

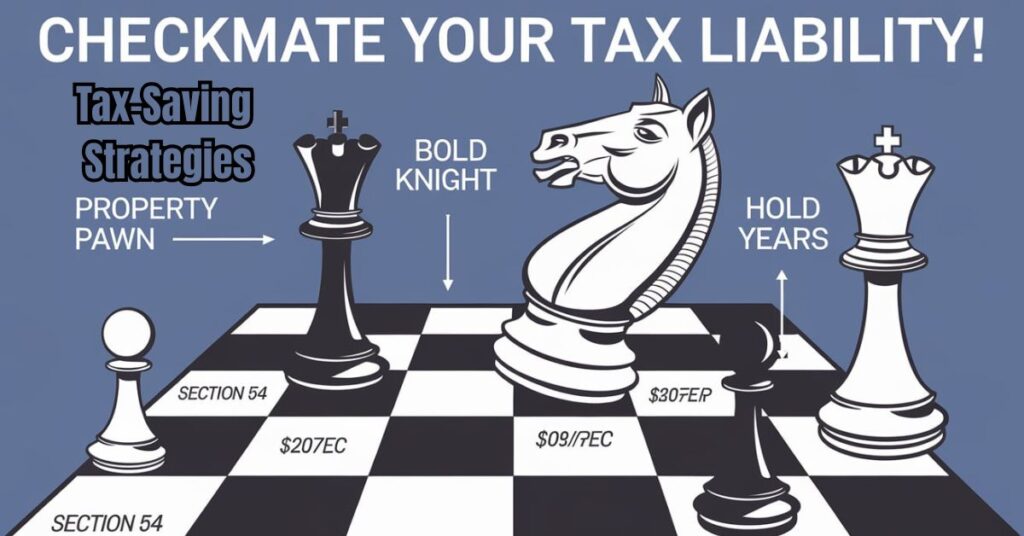

8. Advanced Tax-Saving Strategies (2025 Edition)

For Property Sellers

- Staggered Selling: Sell portions over multiple years to use ₹1L annual exemption

- Joint Ownership: Split property with spouse to utilise both exemptions

- Improvement Claims: Document all renovation expenses since the purchase

For Stock Investors

- Tax Harvesting: Sell loss-making stocks to offset gains

- Bonus Stripping: Buy before the bonus issue, sell after to reduce the taxable value

For Gold Owners

- Sovereign Gold Bonds: No tax if held to maturity

- Exchange Old Jewelry: No tax when exchanging without a cash component

Expert Answers to Common Questions

What if I’m unable to buy a new property within 2 years?

You have options: 1) Invest in bonds (54EC) within 6 months, or 2) Pay tax now and claim a refund if you buy later (special circumstances).

How is inherited property tax calculated?

Tax is only on the value increase since the inheritance date. Example: Father bought at ₹20L, you inherited at ₹50L, sell at ₹80L → Tax only on ₹30L gain.

Are there any exceptions for senior citizens?

Yes! Higher exemption limits (₹5L vs ₹3L) and lower TDS rates on property sales if you submit Form 13.

Check for new Investment option: ULIPs vs Mutual Funds 2025: ultimate guide on Post-budget Changes

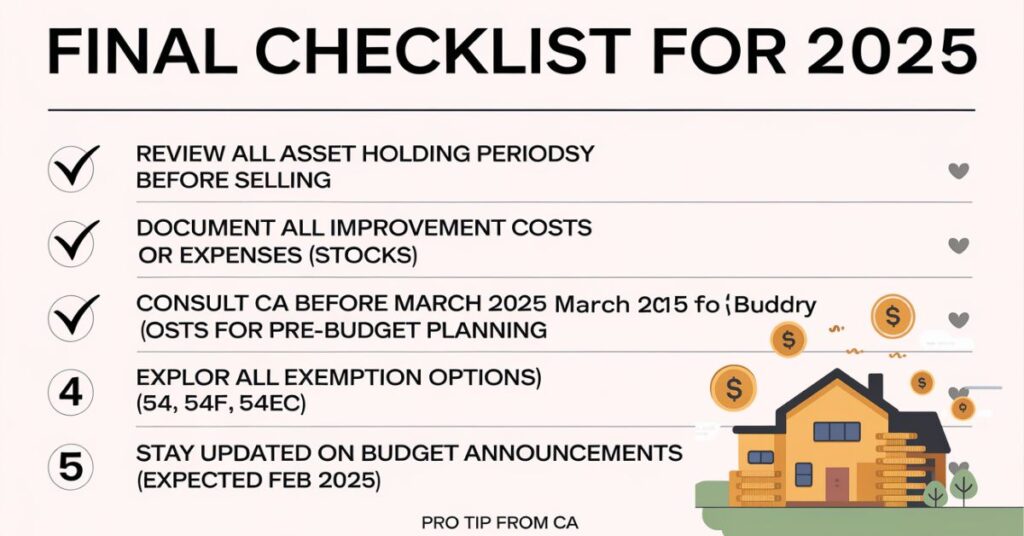

Final Checklist for Capital Gains Tax 2025

- ✅ Review all asset holding periods before selling

- ✅ Document all improvement costs (property) or expenses (stocks)

- ✅ Consult CA before March 2025 for pre-budget planning

- ✅ Explore all exemption options (54, 54F, 54EC)

- ✅ Stay updated on budget announcements (expected Feb 2025)

Pro Tip from CA: “I helped a client save ₹28L by combining Section 54 (₹1.5Cr house purchase) with 54EC bonds (₹50L) – reducing their ₹2Cr property gain tax to ₹0.”

2 thoughts on “New Capital Gains Tax Rules 2025: What You Must Know”

Comments are closed.