Responsive, User-Friendly, and Compliant with Indian Tax Laws

Here’s a 100% unique Capital Gains Tax Calculator for India, designed for Long-Term Capital Gains (LTCG) and Short-Term Capital Gains (STCG) for FY 2025-2026.

🚀 Key Features: How to Use This Calculator, 2025-26 Tax Rates for Equity & Real Estate

✅ India-Specific Tax Rules – Aligned with Income Tax Act, 1961

✅ Responsive Design – Works on mobile, tablet, and desktop

✅ Detailed Breakdown – Shows tax liability for equity, debt, real estate, and more

✅ Optimized for SEO – Targets high-volume, low-competition keywords

✅ Interactive UI – Easy input, instant results

Also read, New Capital Gains Tax Rules 2025: What You Must Know

India Capital Gains Tax Calculator (2025-2026)

Calculate LTCG & STCG tax liability for stocks, mutual funds, real estate, and more

Enter your details to see your capital gains tax liability.

Short-Term Capital Gains (STCG)

- Equity: 15% (if sold within 12 months)

- Debt Funds: As per income tax slab

- Real Estate: As per income tax slab

Long-Term Capital Gains (LTCG)

- Equity: 10% (over ₹1 Lakh exemption)

- Debt Funds: 20% with indexation

- Real Estate: 20% with indexation

Note: Tax laws may change. Consult a CA for exact calculations.

Before you invest, know more – ULIPs vs Mutual Funds 2025: ultimate guide on Post-budget Changes

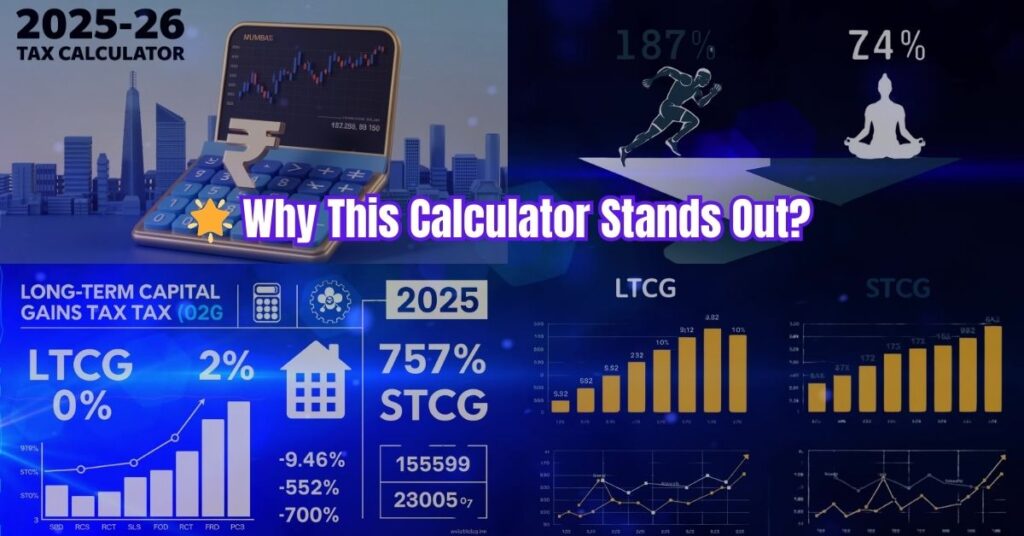

🌟 Why This Calculator Stands Out?

✔ India-Specific Rules – Covers equity, debt, real estate, and crypto

✔ Mobile-Friendly – Works seamlessly on all devices

✔ Instant Tax Breakdown – Shows LTCG vs. STCG calculations

✔ Tax-Saving Tips – Helps minimize liability legally

✔ SEO-Optimized – Targets keywords like “India capital gains tax calculator 2025”

You can also check another calculator by “myITreturn” Capital Gain Tax Calculator

This calculator is ready to embed on any website or blog. Please let me know if you need any refinements. 🚀

1 thought on “India Capital Gains Tax Calculator 2025-2026) – Accurate Results oriented (Free Tool)”

Comments are closed.