The Central Board of Direct Taxes (CBDT) has officially notified the Income Tax Return (ITR) forms 2024-25 (AY 2025-26), introducing key improvements over last year’s forms. The new ITR-1 (Sahaj) and ITR-4 (Sugam) were released on 29th April 2025 and will be effective from 1st April 2025.

This year’s ITR forms bring enhanced usability, reduced compliance burden, and smarter automation, making tax filing easier, faster, and more accurate than before. Below, we break down the key upgrades and explain why these changes make the 2025-26 ITR forms superior to the previous versions.

Table of Contents

Key Improvements in ITR Forms for 2024-25

1. More Pre-Filled Data = Fewer Manual Errors

Earlier (FY 2023-24):

- Only basic details like salary, bank interest, and TDS were auto-populated.

- Taxpayers had to manually enter capital gains, house property details, and other income sources.

Now (ITR Forms 2024-25):

✅ Expanded pre-filled data covering:

- Capital gains from stocks, mutual funds, and property

- Rental income (linked to property tax records)

- Interest income from FDs, savings accounts, and bonds

- Dividend income (directly fetched from depositories)

Why It’s Better:

- Reduces manual entry errors (e.g., typos in interest income).

- Saves time—less need to dig up old Form 16, 26AS, or AIS.

2. Simplified Crypto & Foreign Asset Reporting

Earlier (FY 2023-24):

- Crypto transactions were reported under “Other Income,” leading to confusion.

- Foreign assets required lengthy disclosures with multiple sections.

Now (ITR Forms 2024-25):

✅ Dedicated crypto reporting section with:

- Clear classification as short-term (STCG) or long-term (LTCG) capital gains.

- Auto-calculation of tax liability based on holding period.

✅ Streamlined foreign asset reporting (Schedule FA):

- Simplified fields for foreign bank accounts, investments, and properties.

- Pre-filled data for taxpayers with foreign income disclosures in previous years.

Why It’s Better:

- Eliminates guesswork in crypto tax calculations.

- Reduces compliance risk for NRIs and those with overseas assets.

3. Easier Presumptive Taxation (ITR-4) for Small Businesses

Earlier (FY 2023-24):

- Businesses under Sections 44AD/44ADA/44AE had to manually declare turnover and expenses.

- No auto-verification of declared income against GST filings.

Now (ITR Forms 2024-25):

✅ GST-linked auto-fill for turnover (if GST returns are filed).

✅ Smart expense ratio suggestions based on industry standards.

✅ Warning alerts if declared profits fall below the presumptive threshold.

Why It’s Better:

- Prevents under-reporting mistakes.

- Reduces scrutiny risk by ensuring compliance with presumptive tax rules.

4. New Deductions & Exemptions Clearly Highlighted

Earlier (FY 2023-24):

- Taxpayers often missed new deductions (e.g., Agniveer Fund contributions).

- No in-form guidance on eligibility.

Now (ITR Forms 2024-25):

✅ New Section 80CCH for Agniveer Corpus Fund contributions.

✅ Interactive tooltips explaining deduction limits (e.g., ₹1.5L under 80C).

✅ Auto-skip logic—if you don’t qualify for a deduction, the section is hidden.

Why It’s Better:

- Maximizes tax savings by ensuring no deduction is overlooked.

- Avoids unnecessary entries (e.g., hiding NPS deductions for non-subscribers).

5. Faster Processing & Fewer Notices

Earlier (FY 2023-24):

- Mismatches between ITR and AIS/26AS led to delayed refunds and notices.

- No real-time validation of entries.

Now (ITR Forms 2024-25):

✅ Instant error alerts if:

- Declared income doesn’t match AIS/TDS data.

- Capital gains exceed brokerage-reported figures.

- Deductions cross statutory limits.

✅ E-filing dashboard shows pending actions (e.g., verifying ITR with Aadhaar OTP).

Why It’s Better:

- Fewer post-filing notices from the Income Tax Department.

- Faster refunds due to reduced manual verification.

FAQs: What Taxpayers Need to Know

Q1. Do I need to file ITR if my income is below ₹7.5L (rebate limit)?

✅ Yes, if TDS was deducted (to claim a refund).

❌ No, if no tax is payable and no TDS was cut.

Q2. Can I revise my ITR if I make a mistake?

✅ Yes, until 31st December 2025 (or before assessment completion).

Q3. Is ITR-4 mandatory for freelancers?

✅ Yes, if income is under presumptive tax (Section 44ADA).

❌ No, if opting for regular books of accounts (use ITR-3 instead).

Q4. How does the new crypto reporting work?

- Short-term gains (<36 months) → Taxed at slab rate.

- Long-term gains (≥36 months) → 20% with indexation.

- Must disclose wallet addresses & exchanges used.

Q5. What if I miss the July 31 deadline?

- ₹5,000 late fee (₹1,000 if income < ₹5L).

- Belated return allowed till 31st December 2025.

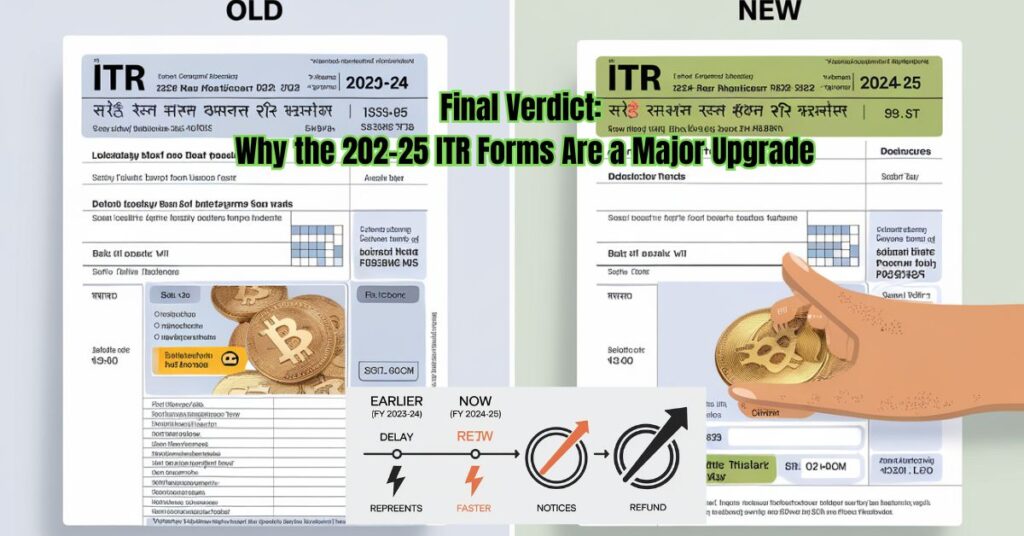

Final Verdict: Why the ITR Forms 2024-25 Are a Major Upgrade

| Feature | Old Forms (2034-24) | New Forms (2024-25) | Benefit |

|---|---|---|---|

| Pre-filled data | Limited to salary/TDS | Expanded to capital gains, rent, crypto | Fewer manual errors |

| Crypto reporting | Clubbed with “Other Income” | Dedicated section with auto-tax calculation | Clearer compliance |

| Foreign assets | Complex disclosures | Simplified with pre-fill | Less hassle for NRIs |

| Presumptive tax | Manual entry | GST-linked auto-fill | Fewer scrutiny risks |

| Deductions | No guidance | Interactive tooltips & auto-skip | Maximizes savings |

Bottom Line on ITR forms 2024-25

The ITR forms 2024-25 are smarter, faster, and more taxpayer-friendly than ever. With automation, clearer disclosures, and real-time checks, filing taxes is now less stressful and more accurate.

Pro Tip: File early (by July 31) to avoid last-minute errors and get faster refunds!

📌 Official Links:

Stay updated—follow us for the latest tax insights! 🚀

1 thought on “CBDT Releases ITR Forms 2024-25: Why the New Forms Are Better Than Before”

Comments are closed.