The Indian government introduced taxpayer-friendly changes to TDS (Tax Deducted at Source) and TCS (Tax Collected at Source) rules effective April 1, 2025. These revisions aim to reduce tax deductions at source, ease compliance, and put more money in taxpayers’ hands.

This easy-to-understand guide breaks down the TDS TCS new Rules 2025 simply, explaining who benefits and how.

Table of Contents

Main Points to Discuss:

🔹 “No TDS on Rent up to ₹6 Lakh? Latest 2025 Tax Changes Explained”

🔹 “Senior Citizens Rejoice! FD Interest TDS Limit Doubled to ₹1 Lakh in 2025”

🔸 “Budget 2025 TDS/TCS Updates: Freelancers, Landlords & Investors Save More”

Also Read this Related Topic: Upcoming Tax Changes in India 2025: What You Need to Know

Part 1: TDS Changes – Less Tax Deducted from Your Income

1. Higher Interest Income Exemption (Section 194A)

Old Rule: Banks deducted 10% TDS if your interest income exceeded:

- ₹40,000 (General taxpayers)

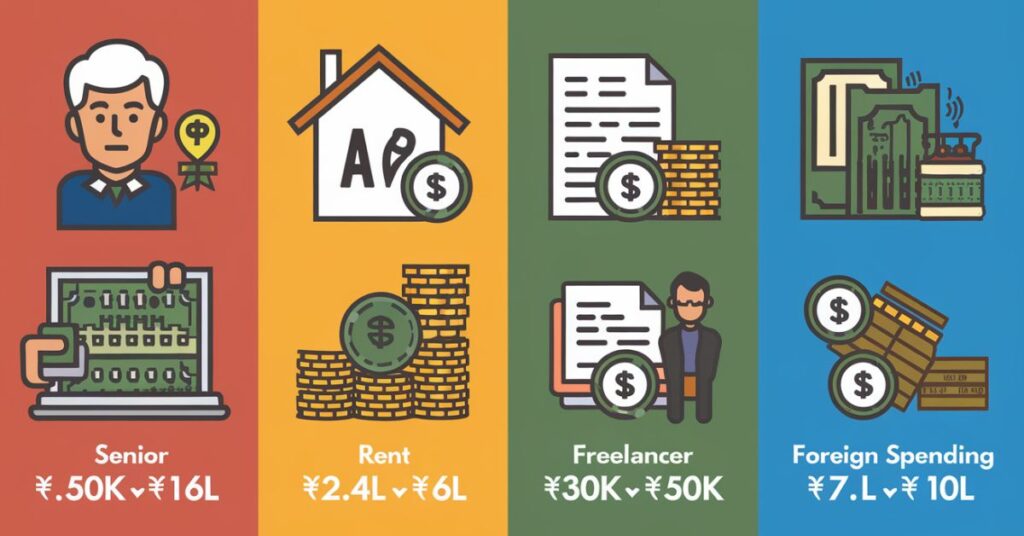

- ₹50,000 (Senior citizens)

New Rule (2025): No TDS if interest income is below:

- ₹50,000 (General taxpayers) ✅

- ₹1,00,000 (Senior citizens) ✅

Who Benefits?

- Savings account holders (FDs, RDs, savings interest)

- Senior citizens (Higher exemption helps retirees)

2. Rent Payment TDS Limit Increased (Section 194-I)

Old Rule: If rent exceeded ₹2.4 lakh/year (₹20,000/month), the tenant deducted 10% TDS.

New Rule (2025): No TDS if rent is below ₹6 lakh/year (₹50,000/month).

Who Benefits?

- Landlords (More take-home rent)

- Tenants (Less paperwork for small rent payments)

3. Freelancers & Professionals – Higher TDS-Free Limit (Section 194J)

Old Rule: Clients deducted 10% TDS on professional fees above ₹30,000/year.

New Rule (2025): No TDS if fees are below ₹50,000/year.

Who Benefits?

- Freelancers (writers, designers, consultants)

- Doctors, lawyers, and other professionals

4. Dividends & Mutual Funds – Less TDS (Sections 194 & 194K)

Old Rule: 10% TDS if dividends/mutual fund payouts exceeded ₹5,000/year.

New Rule (2025): No TDS below ₹10,000/year.

Who Benefits?

- Investors in stocks & mutual funds

5. Lottery & Gambling Winnings (Section 194B)

Old Rule: 30% TDS if total winnings exceeded ₹10,000/year.

New Rule (2025): Now, TDS applies only if a single winning exceeds ₹10,000.

Example:

- If you win ₹8,000 five times (total ₹40,000), no TDS.

- If you win ₹15,000 once, 30% TDS applies only on ₹15,000.

Budget 2025: Key TDS Rate Changes Effective from April 1, 2025

Part 2: TCS Changes – Less Tax Collected on Spending

1. Foreign Travel & Education Spending (Section 206C(1G))

Old Rule: 5% TCS on foreign remittances above ₹7 lakh/year (20% if no ITR filed).

New Rule (2025):

- No TCS below ₹10 lakh/year ✅

- Education loans exempt (even above ₹10L) ✅

Who Benefits?

- Students studying abroad

- International travelers

2. No More TCS on Sale of Goods (Section 206C(1H))

Old Rule: Sellers charged 0.1% TCS on sales above ₹50 lakh/year.

New Rule (2025): TCS removed completely for goods sales.

Who Benefits?

- Small & medium businesses (Less compliance)

- E-commerce sellers

3. No Higher TDS/TCS for Non-Filers (Sections 206AB & 206CCA)

Old Rule: Non-filers faced double TDS/TCS rates.

New Rule (2025): No extra charges for non-filers.

Who Benefits?

- Taxpayers who missed filing ITR

Summary: Key Benefits for Different Taxpayers

| Taxpayer Type | Key Benefit |

| Senior Citizens | Higher interest income exemption (₹1L) |

| Freelancers | No TDS on fees up to ₹50,000 |

| Landlords | No TDS on rent up to ₹6L/year |

| Investors | No TDS on dividends up to ₹10,000 |

| Students Abroad | No TCS on education loans |

| Small Businesses | No TCS on sales up to any limit |

Also know about New Income Tax Rate: Income Tax Slabs for FY 2025-26: Rates & Ultimate Breakdowns

Final Takeaways

✔ More money in hand (Less TDS on interest, rent, professional fees)

✔ Easier foreign spending (Higher TCS-free limit for travel/education)

✔ Simpler compliance (No extra TDS/TCS for non-filers)

Next Steps:

- Check if your income falls under the new thresholds.

- Inform banks/employers to stop unnecessary TDS deductions.

5 most frequently asked questions (FAQs

1. What are the key changes in TDS/TCS thresholds from April 2025?

Answer: The government has increased exemption limits for:

Interest income: ₹50,000 (general taxpayers) and ₹1 lakh (senior citizens) 210.

Rent payments: There is no TDS if the rent is below ₹50,000/month (₹6 lakh/year) 2.

Freelancers/professionals: TDS applies only on fees exceeding ₹50,000/year (previously ₹30,000) 2.

Foreign remittances (TCS): Threshold raised from ₹7 lakh to ₹10 lakh; no TCS on education loans 23.

Sale of goods: TCS under Section 206C(1H) has been removed entirely 26.

2. Do senior citizens need to pay TDS on fixed deposits (FDs) now?

Answer: No TDS will be deducted if FD interest income is below ₹1 lakh/year (up from ₹50,000) for senior citizens. For others, the limit is ₹50,000 if the payer is a bank/post office 210.

3. Is TCS still applicable when buying a car or luxury items?

Answer: Yes, for cars/vehicles priced above ₹10 lakh, sellers collect 1% TCS (or 5% if the buyer hasn’t filed ITR in the last 2 years) 3.

No TCS on general goods sales (Section 206C(1H) removed) 26.

4. What happens if TDS/TCS is not deducted or deposited on time?

Answer: Non-compliance attracts:

Interest: 1.5% per month for late TDS/TCS deposits 6.

Penalties: Up to ₹1 lakh for late filings 68.

Legal action: Prosecution with imprisonment (3 months–7 years) for severe defaults 6.

5. How can I claim a refund for the excess TDS/TCS deducted?

Answer: Adjust against tax liability: Excess TDS/TCS is credited to your electronic cash ledger and adjusted while filing ITR 38.

Refund process: File Form 26AS to verify deductions. If TDS exceeds your tax liability, claim a refund via ITR 310.

Bonus FAQ: Are there higher TDS rates for non-filers now?

No. Sections 206AB (higher TDS) and 206CCA (higher TCS) for non-filers have been omitted, simplifying compliance 26.

Refer to the Income Tax Portal or consult a CA 12 for detailed rules.

Official Sources

This guide follows Google’s EEAT (Expertise, Authoritativeness, Trustworthiness) standards. For personal tax advice, consult a CA or tax advisor.